There are three (3) different ways to make a donation :

- i) Offline Payment

- ii) TouchNGo eWallet

- iii) Maybank QR Pay

Remarks:

- We are registered with tax-exempt status in Malaysia.

- Please email bank slip (indicating "Donation", donor's full name, IC number/ business number & full address ) to This email address is being protected from spambots. You need JavaScript enabled to view it. to be eligible for tax exemption receipt according to Subseksyen 44(6) Akta Cukai Pendapatan 1967.

- We will issue normal receipt (not tax exempt) if incomplete details are given. No tax exempt receipt can be issued after we have issued a normal receipt due to incomplete details.

Our Bank Account

Payable : Lovely Disabled Home

Bank Account : Public Bank Berhad 3134 5487 35

Please Use One Of The Payment Method Below:

Offline Payment

Monetary Donation

TouchNGo eWallet

We are available Touch'n Go e-wallet. You can scan the QR code below to make a donation.

Once you have made the payment, Please email bank slip (indicating "Donation", donor's full name, IC number/ business number & full address ) to This email address is being protected from spambots. You need JavaScript enabled to view it. to be eligible for tax exemption receipt according to Subseksyen 44(6) Akta Cukai Pendapatan 1967.

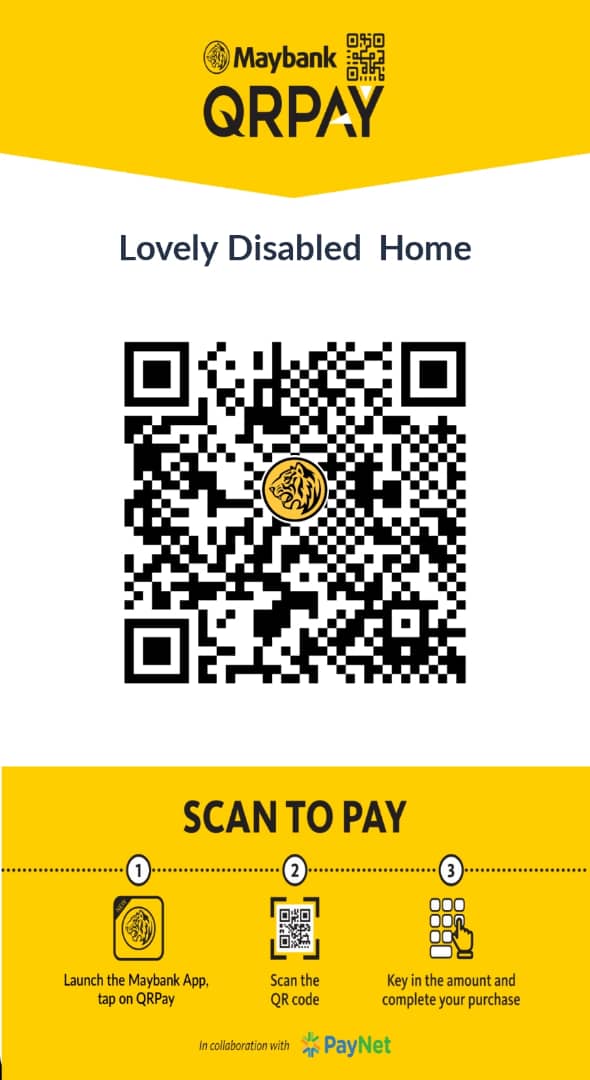

Maybank QR Pay

We are available Maybank QR Pay. You can scan the QR code below to make a donation.

Once you have made the payment, Please email bank slip (indicating "Donation", donor's full name, IC number/ business number & full address ) to This email address is being protected from spambots. You need JavaScript enabled to view it. to be eligible for tax exemption receipt according to Subseksyen 44(6) Akta Cukai Pendapatan 1967.

简体中文

简体中文

English

English